Mastering Your Budget: The Power of Setting Spending Percentages

Creating a budget isn’t just about adding up your monthly expenses and subtracting them from your income. To really take control of your finances, it’s crucial to understand how much of your income should go toward each category. Whether you’re aiming to pay off debt, build an emergency savings fund, or save for retirement, setting budget percentages is one of the most effective ways to keep your financial goals on track.

But you don’t need to be a math whiz to set up a successful budget. With the right strategy and a little planning, you can create a personalized system that works for you. It all starts with understanding your income, tracking your spending, and then strategically dividing your money into categories that reflect your priorities.

Why Should You Use Budget Percentages?

One of the key reasons to use budget percentages instead of just assigning a set dollar amount to each expense is that it gives you a more holistic view of your financial picture. Rather than focusing on one expense at a time, budget percentages allow you to see how each part of your spending fits into the larger puzzle.

For example, let’s say your monthly net income is $5,000. If you set your budget using dollar amounts, you might allocate:

- $1,000 for rent

- $500 for groceries

- $300 for utilities

- $200 for internet and phone services

- $300 for entertainment

- $200 for debt repayment

- $500 for savings

Altogether, that’s $3,000 spent on bills and savings combined, which represents 60% of your income. But what about the remaining 40%? Where is that money going? Using percentages helps you make sense of where the rest of your money should go, and it’s much easier to tweak your budget when you see the full picture.

The “Pie” Concept: How Much Are Your Goals Getting?

Think of your budget like a pie. Each expense category gets a slice of that pie. The bigger the slice, the more of your income it’s taking up. Some of those slices, like housing or utilities, are essential, while others—such as entertainment or eating out—are discretionary. The key question is: how big a slice are your financial goals getting?

For example, if you’re putting just a small portion of your budget toward saving or paying off debt, your financial goals could take longer to achieve. On the other hand, if you’re dedicating a larger portion of your income to debt repayment or saving, you’ll be making progress toward your goals much faster.

Setting your budget percentages based on your income and financial priorities ensures that you’re not just throwing money around randomly. Every dollar gets a job, and that job brings you closer to the financial future you want.

How to Set Budget Percentages That Work for You

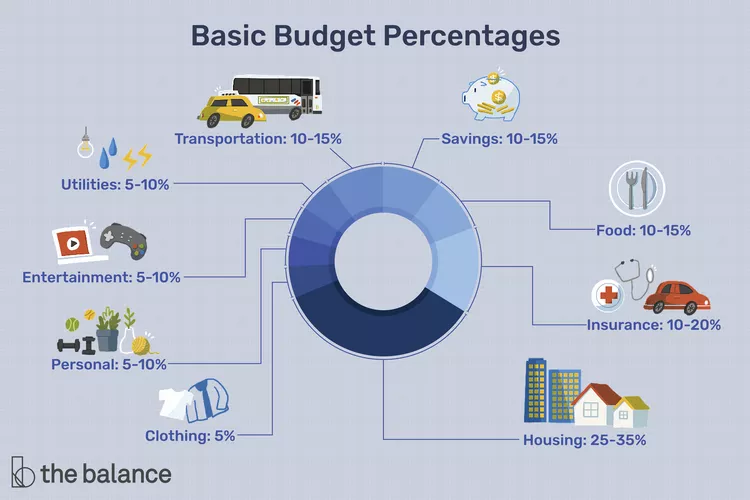

Now that you understand why using budget percentages is important, the next step is figuring out how to set them. While every budget is unique, there are some general guidelines you can follow to get started. Here’s a breakdown of typical percentage ranges for different expenses:

- Housing: 25-35% of your income

- Insurance (health, medical, auto, life): 10-20%

- Food: 10-15%

- Transportation: 10-15%

- Utilities: 5-10%

- Savings: 10-15%

- Fun (entertainment, recreation): 5-10%

- Clothing: 5%

- Personal expenses: 5-10%

These are just starting points. Some categories might take up more, while others might require less, depending on your individual situation. For example, if you live in a city with high rent prices, housing might take up a larger portion of your budget. Similarly, if you have kids, you may need to allocate more for childcare, school supplies, or extracurricular activities.

Account for All Your Expenses

To set your budget percentages accurately, it’s important to account for everything you spend each month. Sure, you know the basics like rent and utilities, but what about those occasional costs like:

- Charitable donations

- Debt repayments (credit cards, student loans)

- Spousal or child support payments

- Pet care expenses

- Daycare or school-related costs

- Travel or vacation funds

- Irregular expenses (like biannual car insurance premiums)

These types of expenses can significantly affect your overall budget and make your percentages look different from the general guideline above. The key to success is being thorough in tracking all your monthly outflows.

How to Track Your Spending

Tracking every expense can feel overwhelming, but with modern tools at your disposal, it doesn’t have to be. Consider using a budgeting app that links to your checking and credit card accounts. These apps automatically categorize your spending, making it easier to stay on top of where your money is going.

Alternatively, if you’re more hands-on, you can use a spreadsheet or even a simple notebook to manually track your expenses. The more consistent you are with recording, the more accurate your budget percentages will be.

Housing: The Biggest Slice of the Pie

For most people, housing will be the largest percentage of their budget. Financial experts often recommend keeping housing costs at no more than 30% of your income. Spending more than that can lead to financial strain, especially if your other expenses start to creep up.

If your rent or mortgage is taking up a larger chunk of your income, you may need to consider adjusting other budget categories, finding ways to increase your income, or even exploring less expensive housing options. The goal is to avoid putting yourself in a position where you’re overspending in one area and struggling in others.

Adjusting as Life Changes

Life is constantly changing, and so should your budget percentages. For example, when you get a raise, you may want to allocate a larger portion of your income toward savings or debt repayment. Similarly, if you experience a big expense, like medical bills or car repairs, you may need to adjust your spending to account for that.

The beauty of budget percentages is that they’re flexible. They give you the ability to adapt to changes in your life while still staying on top of your long-term financial goals.

Final Thoughts: Budgeting with Purpose

At the end of the day, budgeting is not just about crunching numbers—it’s about aligning your spending with your values and goals. By using budget percentages, you’re taking control of your money and making every dollar count. The more you understand where your money goes, the easier it becomes to adjust and prioritize the things that matter most.

Start small, track your spending, and tweak your percentages as needed. With a bit of discipline and a focus on your goals, you’ll find yourself moving toward a stronger, more secure financial future.